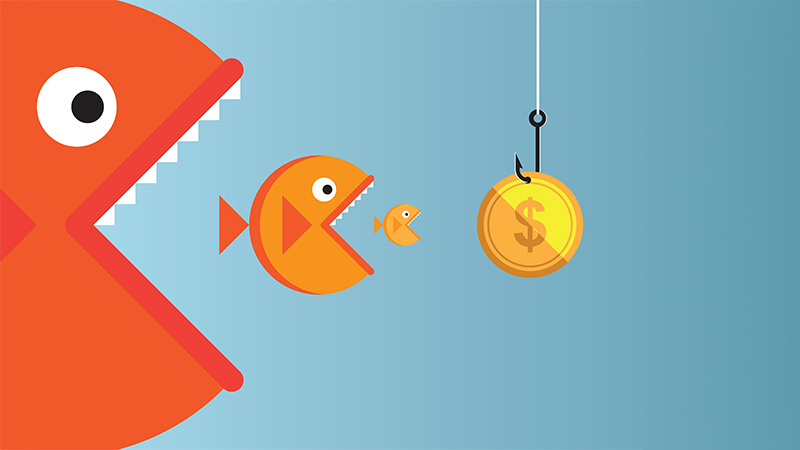

The September consolidation of Aurora and Artemis Alpha marked the 10th and final merger of the busiest ever year for M&A activity among investment trusts. Smaller trusts have been under immense pressure to scale up as wealth managers increasingly allocate to large portfolios that offer greater liquidity. Some of the UK’s biggest wealth groups have combined in recent years – most notably Rathbones and Investec Wealth and Investment– creating inflated assets that require much larger investment vehicles.

Aurora had successfully fattened itself up under the management of Phoenix Asset Management, with its assets under management (AUM) up almost 13 times to £193.6m since the firm took charge in 2016. But despite this growth, large wealth managers were still turning their backs on the trust before the merger with Artemis Alpha took place, according to its chair Lucy Walker.

“While we’d had fantastic organic growth, we knew a transaction would be a great opportunity to bring greater scale and liquidity to the trust,” she says. “Being realistic, the demand for size and scale has only grown since Phoenix took over.”

See also: Investment trusts: Growth story in Japan

Yet even after the merger, the newly re-named Aurora UK Alpha trust is not on the radar of larger wealth managers. A full-scale merger without redemptions would have boosted AUM by 64% to £353m, but many shareholders chose to sell their holdings at a lesser discount amid the consolidation process. The trust is only 34.8% larger than pre-consolidation, with assets of £260.9m as at December.

Walker says the trust will still have to double its size to reach the threshold necessary to even be considered by most wealth managers. It is this rapidly rising bar set by wealth firms that has triggered M&A activity among investment trusts to soar to new heights in 2024, she adds.

“The consolidation of wealth managers has been the catalyst without a doubt. When I was a fund buyer at Saracen, my minimum size was £100m, but that was already too low by the time I left in 2020. Then it went up to £250m, then £500, and even up to £1bn for the largest wealth managers. Clearly there have also been the challenges of interest rates normalising, discounts broadening and cost disclosure, but the single biggest factor has been the consolidation of the client base.”

Read the rest of this article in the January edition of Portfolio Adviser Magazine