By Cameron Shanks, investment analyst at Aegon Asset Management

In the farmlands of Northeast Louisiana, a new crop is taking root. For over a century, Richland Parish has been synonymous with agricultural abundance, but this month, Meta Platforms announced it was cultivating a $10bn data centre project in the region.

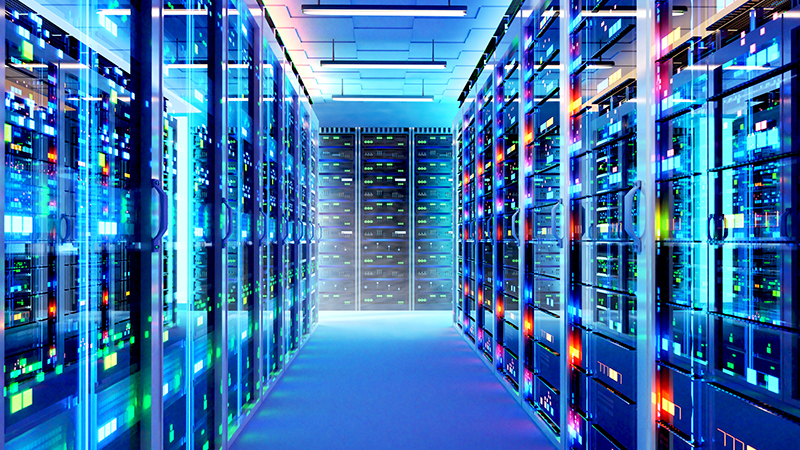

At four million square feet, the campus is more than twice the size of Grand Central Station. This development aligns with a boom in data centre construction, driven by the growing demands of artificial intelligence.

While AI dominates boardroom chatter, many companies are still grappling with its practical application. The real action is taking place behind the scenes. The tangible reality of AI is large data centres, with vast halls of server racks hosting cutting-edge computing power.

Data centres can be split into three building blocks: the shell, grey space, and white space. The shell encompasses land development and the building structure, while the grey space includes the electrical power and cooling systems. The white space contains the IT equipment that powers modern digital operations.

The shell

Data centre construction projects are complex and can take up to seven years before the facility is operational. The construction phase involves erecting the core building structure, installing power substations, and setting up critical infrastructure.

Meta’s Louisiana site illustrates the scale of such an undertaking, where, at its peak, the project will have 5,000 construction workers onsite.

Large-scale construction activity presents opportunities for equipment rental company United Rentals, which offers a one-stop-shop solution for project needs. By providing rental equipment such as excavators and aerial handlers, as well as site security systems including turnstiles and access control, United Rentals captures a portion of the total project cost.

Grey space

AI data centres are power-hungry. Large language models like ChatGPT consume over eight times the electricity per request compared to a typical Google search, and each new generation of AI chips demands even more power.

Access to the main grid has become a critical factor in determining the location of AI data centres. This year, Amazon purchased a campus directly adjacent to a nuclear power plant.

When a data centre is connected to the grid, electricity entering the facility is processed through switchgear and transformers. It then flows through power distribution units before ultimately supplying the facility’s cooling systems and IT infrastructure.

Both Eaton and Schneider Electric provide a range of electrical equipment designed to optimize power distribution throughout these facilities.

In the event of grid failure, backup power generators are essential for AI data centres to ensure continuous uptime and protect against data loss. These systems respond rapidly to outages, maintaining power for extended periods to support the high energy demands of AI computing.

As large language models (LLMs) continue to push the boundaries of compute power, data centres face a new challenge: heat generation. AI servers produce intense heat and must be cooled to stay running. Traditional data centres were designed like cold storage rooms, relying on industrial-scale air conditioning. However, the focus is shifting toward more targeted approaches that extract heat directly at the chip level.

Schneider Electric and Delta Electronics are leading the way in innovative cooling methods, utilizing liquid instead of air. While these techniques are still in their early stages, they are gaining traction in AI data centres due to their superior ability to dissipate heat in high-density computing environments.

Liquid cooling also reduces the energy consumption of data centres. Schneider Electric estimates that cooling systems account for 50% of a data centre’s power usage, making these techniques a valuable solution to alleviate the strain on the limited capacity of the US electricity grid.

AI paying dividends

For the companies mentioned, we anticipate that the continued demand for AI will drive strong growth in both earnings and dividends. This convergence of data centre expansion needs presents a compelling case for investors seeking exposure to the AI theme through established companies with strong dividend growth potential. Our central conviction is that the growth in dividend income dominates equity returns through time.

While the stocks are not typically considered high yield, distributing around one third of profits to shareholders, this illustrates a dividend sweetspot. Companies that strike the optimal balance between returning capital to shareholders and reinvesting profits in the business to fuel future earnings growth. When combined with long-term holding periods, shareholders in such companies are often rewarded.